Over the past few years, affordability has been one of the biggest challenges for homebuyers across Westlake Village, Thousand Oaks, Agoura Hills, Simi Valley, and Newbury Park. Rapidly rising home prices and higher mortgage rates left many feeling stuck—unsure if it was the right time to buy or move.

But there’s encouraging news for buyers and sellers in the Conejo Valley real estate market. While affordability is still tight, mortgage rates have finally shown signs of stabilizing. This gives you a clearer picture of what to expect and makes planning your next move more manageable.

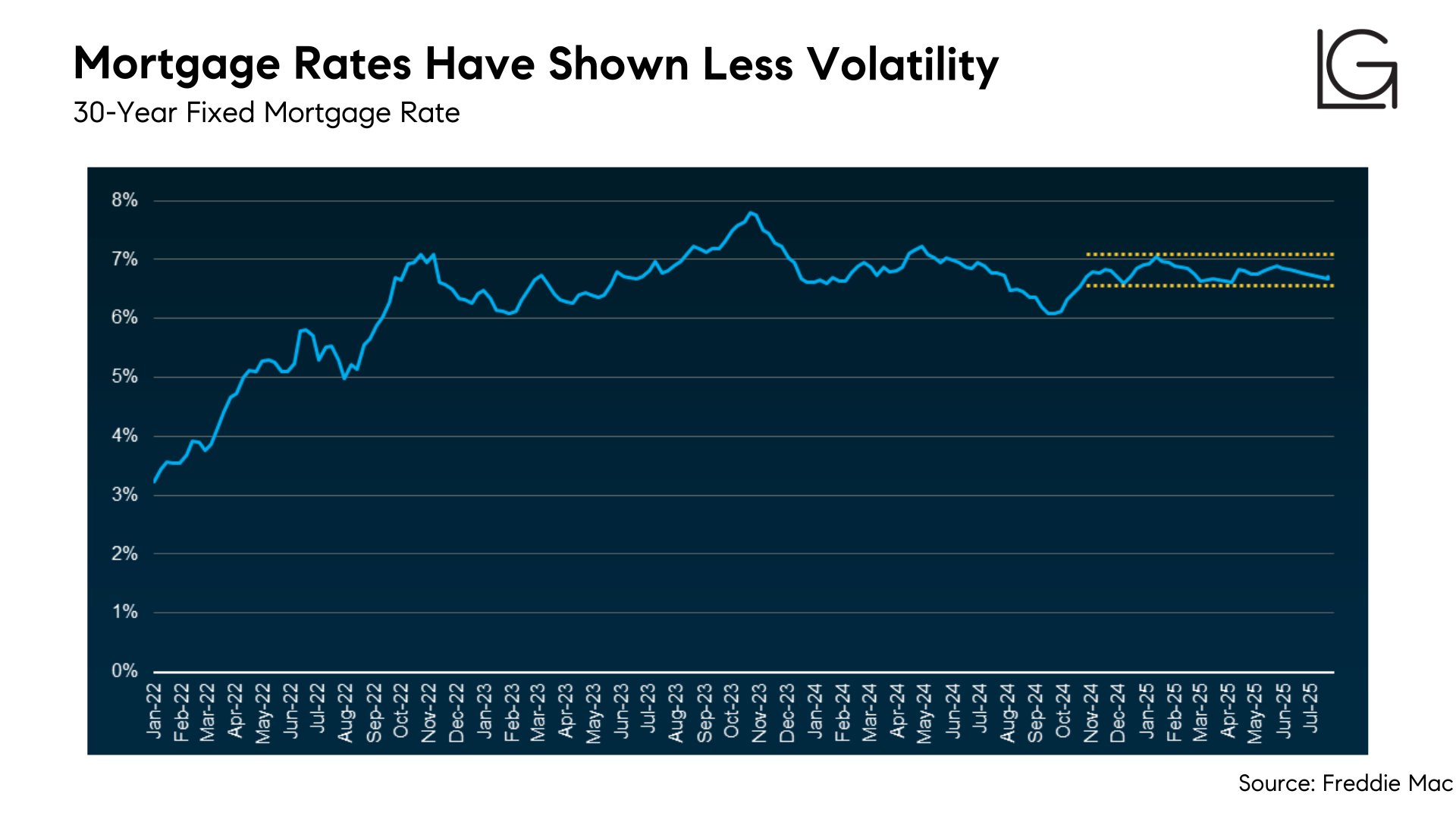

Mortgage Rates Have Leveled Out—For Now

Over the past year, mortgage rates have had their share of ups and downs, making it tough to plan ahead. But lately, they’ve settled into a more predictable range, hovering in the mid-6% range without the wild swings we saw before.

As HousingWire explains:

“Analysts, economists, and mortgage professionals are coining this quarter’s activity as one of the most calm periods for mortgage rates in recent memory.”

For buyers in Thousand Oaks, Westlake Village, and Agoura Hills, this stability means you can get a more realistic idea of your monthly payment—without worrying that rates will jump dramatically from week to week.

How This Helps Conejo Valley Buyers

When rates are unpredictable, it’s hard to move forward with confidence. But with the steadier trend we’re seeing in Conejo Valley mortgage rates, planning your next step—whether buying a home in Simi Valley or downsizing in Newbury Park—feels much more doable.

Even though rates may not be at historic lows, they’re far less volatile now. That means you have a more predictable window to make a move without constantly second-guessing the timing.

Will Mortgage Rate Stability Last?

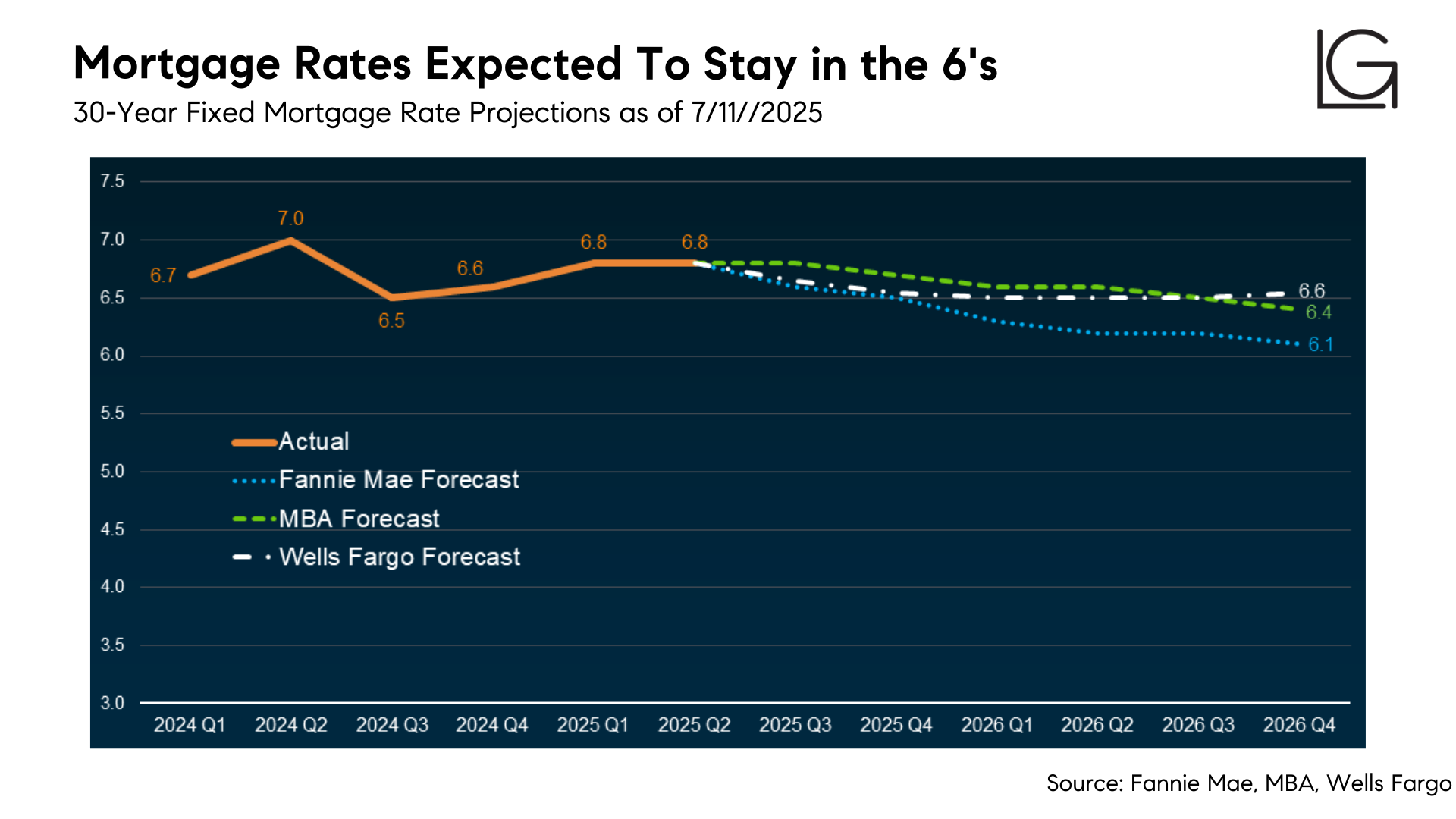

Experts believe rates may edge down slightly in the months ahead, but any changes are expected to be slow and modest. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

Trying to “time the market” isn’t a winning strategy. As Jeff Ostrowski, Housing Market Analyst at Bankrate, puts it:

“There’s no guarantee that rates are going to be any more favorable in three months or six months.”

Looking further out, most forecasts predict rates will remain in the mid-6% range through 2026, which means today’s market may already offer one of the better opportunities you’ll see for a while.

What This Means for You

In Conejo Valley, where demand remains strong and inventory is improving, this rate stability creates a window of opportunity. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have moved within a narrow range for the past few months… Rate stability, improving inventory, and slower house price growth are an encouraging combination.”

Of course, mortgage rates still respond to the economy, inflation, and other factors—so they can shift again. But right now, you’ve got more predictability than you’ve had in years.

Bottom Line

While affordability is still a challenge in places like Westlake Village, Thousand Oaks, Agoura Hills, and Simi Valley, the recent stability in mortgage rates makes it easier to plan your next move.

Want to see what your monthly payment might look like in today’s market? Let’s connect and run the numbers so you can move forward confidently—whether you’re buying your first home in Newbury Park or upgrading to your dream home in Conejo Valley.

📲 Contact us today to explore your options!